When you apply for a loan, a lender cares about how much you already borrow compared to how much you earn.

This is what they call a ‘debt ratio’.

Simply put, a debt ratio is how much you’re borrowing (excluding the mortgage) divided by your income.

The higher the debt ratio the less likely you are to be accepted for a loan.

Lenders use three ratios:

Annual debt ratio

The annual debt ratio relates to the ratio of total credit to annual income.

Credit means all the accounts you have, including credit cards, mobile phones and loans. It does not include any first mortgage you may have.

For example:

- Alice has £20k in loans and has an annual income of £24k this is a ratio of 83% (£20k / £24k)

- Bob has £10k in loans and has an annual income of £30k this is a ratio of 30% (£10k / £30k)

Monthly debt ratio

The monthly debt ratio relates to the ratio of monthly payments on accounts to monthly income. In other words how much of your income is being used to pay creditors each month? All data at a Credit Reference Agency is monthly.

For example:

- Alice earns £1,500 each month. They spend £500 on repaying loans and other credit agreements. This is a ratio of 33% (£500 / £1,500).

- Bob also earns £1,500 each month. But they only spend £200 on repaying loans and other credit agreements. This is a ratio of 13% (£200 / £1,500).

Revolving debt ratio

The revolving ratio relates to the amount of credit you’re using compared to the limits provided by a lender. This applies to what are sometimes called revolving credit agreements; credit cards and overdrafts.

For example:

- Alice has a credit card balance of £9,000. They have two cards with total limits of £10,000. This is a ratio of 90% (£9,000 / £10,000).

- Bob has credit cards balances of £1,000. They also have two cards with total limits of £10,000. This is a ratio of 10% (£1,000 / £10,000).

In all the examples above, Bob is much more likely to get the loan than Alice.

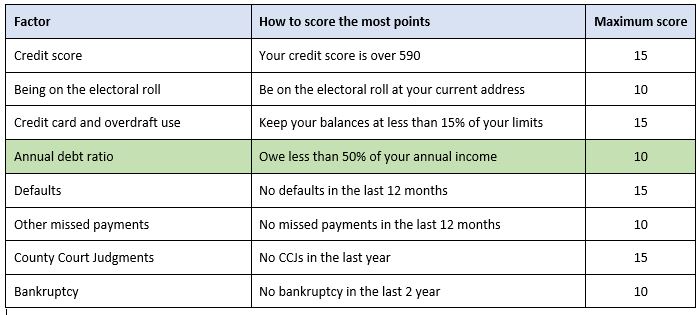

The NestEgg app awards up to 10 points for being below 50% annual debt ratio: