So, what exactly is credit scoring?

A credit score is a three-digit number that can determine whether your loan application is accepted.

Also, credit scores are used to set the interest rate that you are charged for borrowing. Consequently, you might have to be above a certain score to get services, like a mobile phone contract or cheaper gas and electricity.

Hundreds of factors contribute to a credit score. We investigate these as part of our guide to improving your score. Importantly, a score can vary from month to month.

Credit scores are provided by the three main Credit Reference Agencies (CRA): Experian, Equifax and TransUnion.

Each CRA uses a slightly different scoring system. Experian, for example considers a score to be poor if it is under 750. TransUnion scores are poor if they are under 600.

Why is it important?

A better credit score can mean reduced interest rates for loans. A higher score increases the likelihood that you will be accepted for a loan.

Because of this, better scores also help you get better deals on other bills, like phones, gas or electricity.

What do I need to do?

You can take a lot of actions to improve a bad credit score. Additionally, there are many things to do to enhance a score that might be considered OK. Even when your score is good – you can always do more!

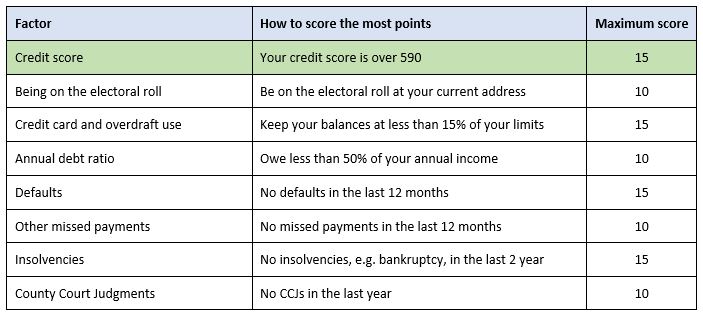

The NestEgg app awards up to 15 points, depending on how high your TransUnion credit score is: