National Fraud Awareness Week is an opportunity to think about how to protect yourself against Covid-19 scams.

Covid-19 has generated 1000s of scams. Emails, phone calls and text messages are designed to con you into spending cash at a time when you can least afford it.

Scams may seem familiar. Often they are re-runs of earlier attempts at fraud. Scams are are designed to:

- Obtain your card payment details for an immediate payment. Subsequently these details are used for additional unauthorised transactions.

- Gather personal identifiable information (e.g. your address, date of birth) which may be used to impersonate you as a way to obtain financial services (e.g. loans) in your name. This is also known as identity theft.

Remember:

- If it sounds too good to be true, it probably is.

- The government does not charge you to apply for Coronavirus support.

- If, with hindsight, you think you’ve given your bank details to a scam, tell your bank immediately.

Here are three examples of Covid-19 related scams, together with tips to protect yourself against Covid-19 scams.

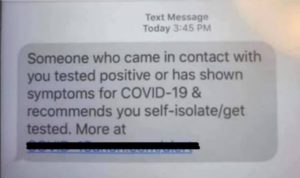

Example 1 – Track and trace

The government will contact you by text or in-app message if you’ve been in contact with someone who has Coronavirus. Because of this, 1,000s of text messages being sent by scammers which send you to a fake website in an attempt to get you to pay for a test and / or obtain your personal details.

Remember:

- All Coronavirus testing on the NHS is free.

- The government will not ask you for your personal details in a text message.

- The only official website address is https://contact-tracing.phe.gov.uk. Only when logged into this website will you be asked for person details and these DO NOT include you bank account.

Example 2 – Government grants

There’s help for people suffering financially because of Covid-19. These include self-isolation grants, Bounce Back loans and the ability to delay payment of certain taxes.

Again there are no fees to pay when claiming a government grant. You should only logon to make a claim using a .gov.uk website. And no government department is going to email or text you about a tax rebate. HMRC have published a list of example ‘phising emails’.

Example 3 – Loan acceptance fees

These are scams where you pay a fee on the basis that you’ll be granted a loan.

Such scams are effective. An email may arrive shortly after you’ve made an application for a loan. Scammers may claim that the fee is refundable and will be used as a deposit, administrative fee, insurance or because of bad credit history.

You’re likely to be asked to make an upfront payment into a bank account. Furthermore, a request for an unusual payment should alert you to a scam. For example, asking for payment via Western Union or in vouchers.

Remember

Only companies authorised by the Financial Conduct Authority can act as brokers. They should send you a notice setting out their name as it appears on the Financial Services Register, a statement that they are acting as a broker and details of any charges.

Protect yourself – in 3 steps

Fraud action recommend a three step approach:

STOP

Taking a moment to stop and think before parting with your money or information could keep you safe.

CHALLENGE

Could it be fake? It’s ok to reject, refuse or ignore any requests. Only criminals will try to rush or panic you.

PROTECT

Contact your bank immediately if you think you’ve fallen for a scam.

You can also use the FCA Warning List to check who you are dealing with.

Your default position should be to reject offers that come out of the blue. Additionally beware of adverts on social media and do not click links or open emails from senders you don’t already know. Always avoid being rushed or pressured into making a decision. Importantly, do not give away your personal details unless you know and trust the organisation you’re dealing with.

Additionally, be careful of any games you play on social media. For example, we’ve seen online games ask questions including, your mum’s maiden name, the name of the street you grew up in and your firs pets name. All of these are banking security questions. Don’t give them away!

However, if you have been a victim of fraud, the Money Advice Service provides information on how you might be able to get your money back.