When you apply for a loan, a lender cares about how much you already borrow compared to how much you earn. This is what they call a ‘debt … Read More about What you need to know about debt ratios

Why being at your credit limit reduces your credit score

You might have a great credit score but... If you are... At your credit card / overdraft limits AND Spending a significant proportion of … Read More about Why being at your credit limit reduces your credit score

Get a loan you can afford

Getting the right loan with payments you can afford has always been a challenge. And the consequence of getting things wrong are expensive. Finding … Read More about Get a loan you can afford

Being on the electoral roll is a sign of stability

Lenders love stability. Living in the same house. Staying in the same job. Only applying for credit occassionally. The electoral roll is an indicator … Read More about Being on the electoral roll is a sign of stability

If your credit repayments are under control it may be time to start saving

If you're managing to stay on top of your credit repayments and generally spend less than 10% of your monthly income on debts then … Read More about If your credit repayments are under control it may be time to start saving

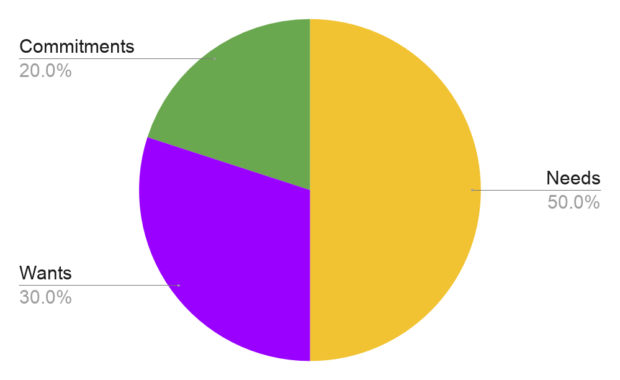

Say hello to the 50-30-20 Rule!

Trying to get your monthly debt spend down can be hard. Getting our spending into some sort of order is essential but most of us hate … Read More about Say hello to the 50-30-20 Rule!